Bitcoin as a Medium of Exchange

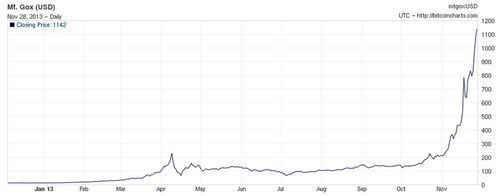

Bitcoin — the decentralized digital currency — has been making a lot of headlines lately. Much of this is driven by the current investment boom around it that has raised the exchange rates over the 1000 USD mark. But really, looking at Bitcoin as a medium for currency or asset speculation is a bad idea. Instead, we should see it purely as a medium of exchange.

Not a great holder of value

Much of the press stories about Bitcoin see it as a speculative investment free of currency manipulation by central banks. By its nature, it is a deflationary currency, given that the global supply of Bitcoins is capped. As long as there is interest in Bitcoin, it means the prices are bound to go up. But at the same time, this is a threat to the currency. Deflation disincentivizes people from spending their money, as tomorrow the value is likely to be higher.

This is a big difference to fiat currencies where central banks generally act to ensure that there is a little bit of inflation, giving people incentives to spend, invest, and keep the economy running.

Traditional currencies are given a value by the fact that there is a government requiring taxes to be paid in them. This creates a demand in the currency, as people have to acquire units of that currency somehow, usually by selling goods and services. So, the value of a currency is built on the power of a state to tax its subjects in that currency.

The other traditional holder of value, gold, also differs from Bitcoins in the sense that at least you can make some useful things out of it.

In contrast, the value of Bitcoin without an economy backing it up is exactly zero. Without an active network of miners, and business transactions that create a demand for them, there is not much you could do with a Bitcoin.

Given this setting, Bitcoin as a investment mechanism resembles a ponzi scheme where people make speculative investments in them in hopes of being able to pass them on to the next fool when the prices go up.

This is obviously not sustainable in the long term. But luckily there are things you can do with Bitcoin that still make them interesting if you deal with them as a medium of exchange and not a long-term holder of value.

Great tool for conducting transactions

Now that we’ve established that Bitcoins are not the best thing to put your life savings into, or to stash under your mattress, what is it exactly that makes them interesting?

Mobile money

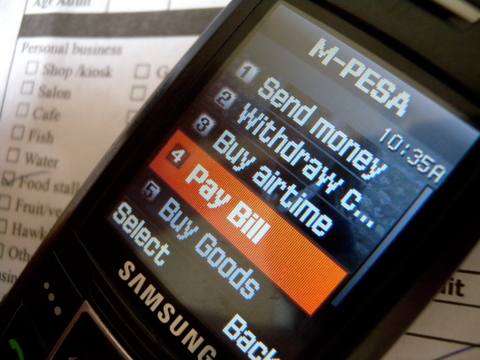

Bitcoin is a way of making transactions quickly, safely, and without middlemen. A lot of the articles written about it compare it to gold, but in my view a much closer comparison is M-Pesa, the operator-driven mobile payment network that powers over 30% of the Kenyan economy.

M-Pesa on a phone, by Pixel Ballads

When you see people paying with their mobile phones in a African street market, you know they’ve leapfrogged us in technology.

Bitcoin has the exactly same advantages as M-Pesa: you can send it to anywhere with minimal costs and delays, you can keep it on your phone, and anybody can ask for a payment through it. Unlike M-Pesa, Bitcoin is truly decentralized and doesn’t rely on a mobile operator to act as the “central bank”.

Unlike M-Pesa, Bitcoin currently requires an internet-connected smartphone with a wallet application. This limits its usefulness in the world outside of the rich countries (though cheap Android phones are changing the situation). It would be a huge boost for mobile commerce with Bitcoins if there was a service that enabled paying and requesting Bitcoin over SMS.

The one to make Bitcoin work over SMS will be rich

Last summer I was talking with Joerg Patzer, the owner of Room 77, a restaurant in Berlin that has been one of the early adopters of Bitcoin. At the time about 10% of the his sales happened in Bitcoin, and the number has been constantly growing since. He told that he even pays some of his suppliers in Bitcoin, and only converts some of it to euros, solely because you can’t pay taxes in Bitcoin.

Patzer buys the beer for Room 77 from the nearby Rollberg brewery, owned and run by qualified brew and malt meister Wilko Bereit. He pays for the barrels with Bitcoins

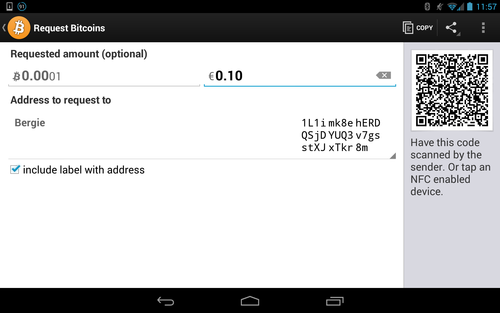

Joerg also told me an interesting case where there was a group of tourists having a dinner in his restaurant. A friend of theirs that wasn’t able to make the trip insisted on paying the bill remotely from Israel. This is something that would be hard to do with the traditional credit cards or currencies. Paying in Bitcoin is quite straightforward:

He taps the amount he owes Room 77 into the virtual Bitcoin wallet on his Android phone and, aligning it with a code on the bar’s device, presses a button to process the payment. A theatrical “kerching” sound follows and Gallas is grinning from ear to ear. “It could hardly be easier,” he insisted.

Requesting a payment using Bitcoin Wallet for Android

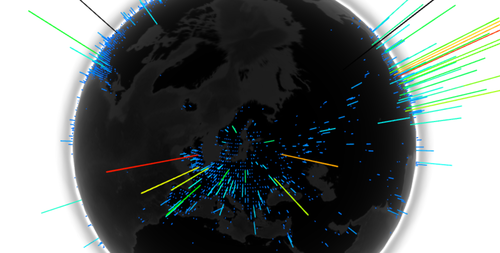

Global currency for the internet

Requesting Bitcoins is as easy as providing a URL. This could be presented as a link on the web, or shared to mobile devices via QR Codes. For example, clicking this link on a device with a Bitcoin wallet would enable you to send me Bitcoins worth around 0.1 EUR (on today’s exchange rates). No need for dealing with payment gateways or complicated protocols.

Ease of paying, no middle men, minimal transaction fees, and no risk of chargebacks make a lot of interesting business scenarios possible online. Consider for example micropayments for online content. This is something that would make online publishing viable without the current ad-driven models, but has been held back by the risks and costs associated with credit card payments. Wider adoption of Bitcoin would suddenly make this a very realistic way of asking for money for the things you do online.

Other clever uses

Since Bitcoins can be exchanged in miniscule amounts, and there is a public record kept on each transaction, they enable all kinds of new use cases.

One such service that I ran into yesterday is Proof of Existence, a tool for storing the fact that you were in possession of a document at a given time, and that it hasn’t been revised since based on microtransactions stored in the Bitcoin block chain. This is a mechanism known as trusted timestamping that could be useful for things we currently utilize notaries for. The Hacker News thread on this listed some interesting use cases, like verifying scientific priority on new inventions, i.e. that you had written a document describing a new invention at a given time even if you publish it only later.

We could also use Bitcoin for solving the spam problem. Emails could be “stamped” with a Bitcoin microtransaction, and email servers could be configured to reject messages that don’t have a valid payment attached to them. This would enable bringing decentralization back to the internet as we could again use distributed systems like email and XMPP without having to resort to the walled gardens like Facebook to keep them spammers away.

Another interesting approach was to use Bitcoin transactions for making bets.

How to get started

A good way to get started with Bitcoin is to read Wired’s Bitcoin survival guide or the materials available on Bitcoins.com. Install a Bitcoin wallet application on your mobile device. Then get some Bitcoin either by buying locally, from an online exchange or by selling goods or services for Bitcoin.

This is all you need to get going. Now you just need to find a way to spend them, for example in online shops, by buying domains, or in shops and restaurants that accept them, like many do in my neighborhood.

Disclaimer: I’m a programmer, not an economist. There are better people to take investment advice from. I do hold a little bit of Bitcoin, giving me some vested interest in the matter. Not the kind of amount that would make it an investment, but just the right amount for being able to buy a few nice dinners, especially at the Berlin prices. Generally, I try to keep the amount I have in BTC low enough to be equivalent of what I might be comfortable with carrying in cash.